Use this Living Trust / Estate Plan software template to be sure.

Get started with this comprehensive software system, analyze your estate value, allocate assets, save on legal fees.

Whether your estate is worth $500,000 – $50 million,

Living Trust Builder helps you write a living trust quickly and easily

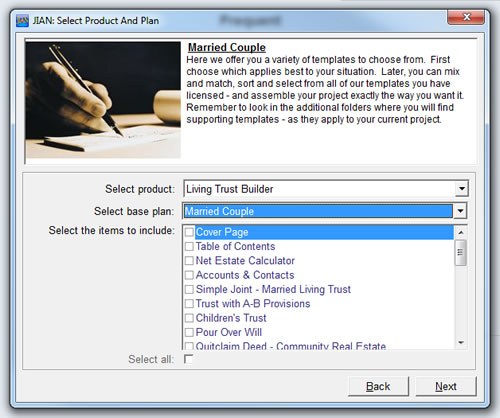

Menu-driven from start to finish, Living Trust Builder provides entrepreneurs and business owners with the most sophisticated living trust development software and document templates available to organize your wishes, calculate your estate, and express your desires with clarity.

Living Trust Builder chunks living trust preparation into a series of short sections that help you to address every aspect of your estate plan.

One thing about Living Trust Builder is you’ll appreciate all the things you’ve accumulated what you have you been enjoying all your life. In choosing your team will to take over upon your departure, you’ll assess and appreciate the qualities of the people around you.

Get started with this comprehensive software system, analyze your estate value,

allocate assets, save on legal fees.

Do you know that you need a Living Trust?

If you’re single and have assets over $5,340,000, or combined assets of $10,680,000 if you’re married (or if you have parents or grandparents who fit into this category), keep reading. You need a living trust.

If you don’t get one, you’ll be giving hundreds of thousands to the government when you die, rather than passing your hard-earned assets on to your heirs.

The good news is, Living Trust Builder gives you the mechanisms and sound planning advice that can often save you from paying every cent of estate taxes, gift taxes and probate fees. And, if your estate is so large that some estate taxes are inevitable, we can teach you a smart way to avoid paying them through a strategic life insurance plan. Of course, none of us wants to think about “the end,” but knowing that you’ll finally win the tax battle with the IRS might make the thought a little easier.

How to control your legacy

A living trust gives you more than just potential tax and probate savings. It also provides control. Control over how your affairs are managed after you pass on. Control over what happens to your business. It even gives you more control when you’re alive, by providing specific provisions on how you want to be cared for in the event of serious illness or incapacity, and how you want your affairs to be managed during that time. And when you know you’ve planned for every contingency, it gives you something even more priceless – peace of mind.

On how much to leave your kids… “The perfect amount is enough money so they would feel they could do anything, but not so much that they could do nothing.”

– Warren BuffettOn how much to leave charity… “99% of what I have will go back to society through philanthropy, because I’ve been treated extraordinarily well by society…”

– Warren Buffett

Wizard-driven system puts it together for you

Our software system helps you all the way along. No new software to learn! There are no tricky computer programs or applications to learn. (Already have and use Word & Excel?) As soon as you download Living Trust Builder you can get started right away…

Your blueprint for the future

Find peace in knowing that you’ve done the right things for yourself, your business and your family: A living trust can protect your business, manage how you are treated should you become ill, give you control over what happens after you die, save your heirs hundreds of thousands of dollars in taxes.

Estate Planning Document Templates Included:

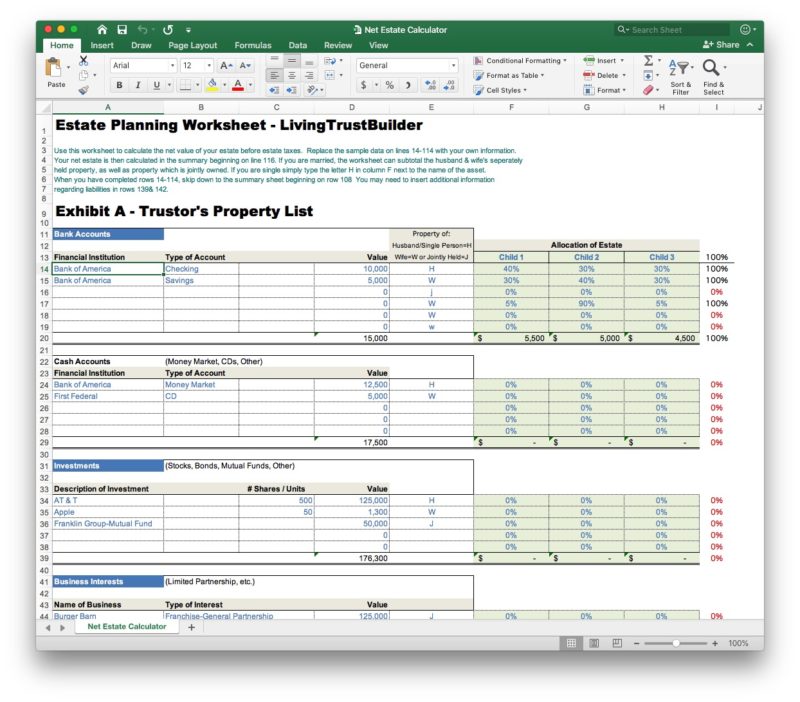

Organizes Your Estate

- Net Estate Value Calculation Worksheet

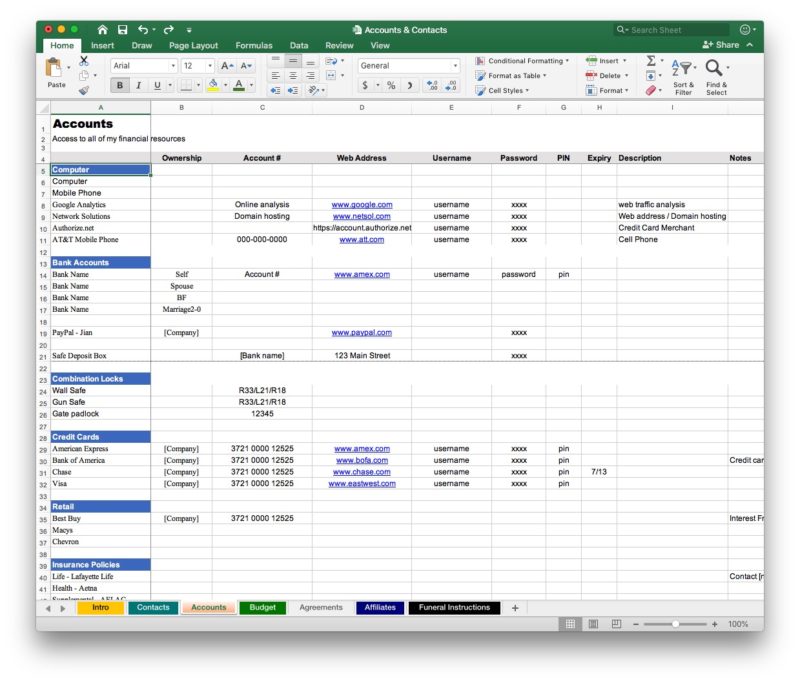

- Accounts & Contacts (All passwords, PINs, account #s, etc.)

- Business Succession Planning

- Incapacity, Long-Term

- Illness and Disability

- Guardianship for Minor Children

- Who Will Manage My Living Trust?

- Who Will Receive My Assets?

- Transferring Property to Your Trust

- After Death Checklist

- Glossary

Business Document Templates

- General Partnership Agreement

- Corporate Buy-Sell Agreement

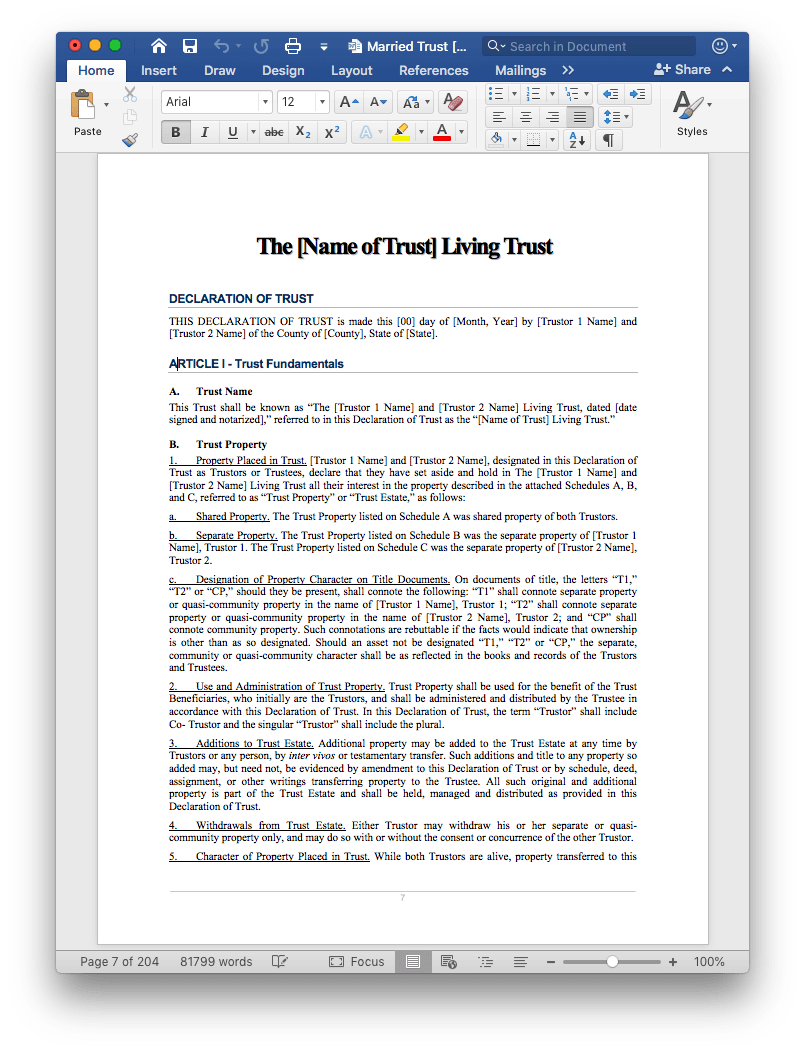

Components of a Married Living Trust

- A-B Married Trust

- Married Person’s Trust (without A-B provisions)

- Children’s Trust

- Husband & Wife Pour-Over Wills (with A-B Provisions)

- Husband & Wife Pour-Over Wills (without A-B Provisions)

- Asset Power of Attorney (Husband)

- Asset Power of Attorney (Wife)

- Married A-B-C Trust

- Married Assignment Deed of Trust

- Married Quitclaim Deed

- Health Care Power of Attorney (Husband/Single)

- Health Care Power of Attorney (Wife)

- Directive to Physicians (Living Will)

- HIPAA Privacy Authorization

- Married Amendment to Trust

- Revocation of Married Trust

- Transfer of Assets Letter

Single Person Living trust

- Single Person’s Trust

- Single Assignment Deed of Trust

- Single Quitclaim Deed

- Single Pour-Over Will

- Asset Power of Attorney

- Health Care Power of Attorney

- Directive to Physicians (Living Will)

- HIPAA Privacy Authorization

- Transfer of Assets Letter

- Revocation of Living Trust

- Single Trust Amendment

Comprehensive financial planning book included

“Ready for Pretirement”

Ready for Pretirement is a comprehensive guide both the covers everything you need to know that retirement planning. Author Kris Miller breaks down the big, scary money words and turns able to understand provide the tools you need to get started immediately.

“Many people think retirement planning is just for seniors. But Miller taps and vast estate planning experience to tell you why you should start planning now even your 20s, 30s, or 40s. Don’t wait until it’s too late. Follow Miller’s advice to retire prepare for retirement.”

~ Danette Kubanda, Emmy-winning television producer, writer and publicist

60-Day “Get-the-Job-Done” Guarantee

It’s easy to get started!

Sometimes the best way to see if something fits what you are doing is to just try it. If you download Living Trust Builder now, you can see how well it handles your specific needs and fits the nuances that make your estate plan. If it’s not right for you, we will pay you back—there’s nothing to ship, no taxes, and you can keep the software anyway (your karma can be the judge!).

Now you can complete your living trust with Living Trust Builder software.

With expert business advice at every step of the process, plus a qualified review, this crucial project can be behind you.

Windows version $67

Purchase & Download Living Trust Builder for Windows: $67

Apple Macintosh version $67

Purchase & Download Living Trust Builder for Mac: $67

UPGRADE

Already have an older copy of Living Trust Builder?

Click here to purchase the UPGRADE for just $67