Investment Banker writes to a client…

Dear (Client Name),

I had the opportunity to review your business plan today and I have the following comments, which I hope you will find useful.

The safety restraint system you have designed and patented is, indeed, potentially disruptive within its niche. As so often happens in the venture capital world, however, the approach to VCs and resultant presentation are the keys to actually attracting an appropriate and synergistic capital partner. It’s not all about the money, because you need to consider your capital partner a “true partner” in every sense of that phrase. If you wouldn’t have them in your home for Thanksgiving dinner, don’t accept their money.

Back to the approach and presentation: We review some 2,500 executive summaries/business plans each year. Most we politely decline within minutes. In order for VCI to offer its representation to a firm seeking capital from within the primary venture markets (please see the attached corporate brochure, which describes our three divisions), the deal must have outstanding (initial) management, a thorough understanding of the technological, market and execution risks faced by the company (and potential solutions to each) and a product and/or service that thoroughly disrupts the status quo. There are many fine firms that come to us seeking representation that we decline to represent, simply because they are not “venture fundable.” Venture capital is the most expensive money out there and the potential returns must be strong enough to warrant 1) investment by the VC and 2) acceptance of substantial dilution by the founders.

The business plan that you have in place today is not in a form that would be acceptable to VCs. In order to put together an outstanding business plan, we suggest you purchase the BizPlanBuilder software from JIAN [Business Power Tools]. BizPlanBuilder is cheap — $150 — and those who have used it have raised more than $1Bn in venture capital. It is the preferred format for VCs and we know the software well. In order to purchase the software, simply go to BusinessPowerTools.com.. The software is intuitive, simple enough for a 10 year old to master and truly the best on the market today.

Further comments:

1. We urge all clients to stay away from “selling shares” at a predetermined price. By setting your own pre-money valuation you are, potentially, leaving cash/equity on the table. Let the VC make an offer – why sell yourself short?

2. We know more than 3700 VCs on a global basis, with some 2500 being US based. Consumer and Business Products is a rough category to acquire funding for, primarily because Products VCs want to see revenues. Your advantages, which can be used to offset this mindset, are your IP and ease with which outsourced manufacturing can be set into motion. Still, my sense is that Product VCs are going to want to see at least preliminary orders/customers. Who do you have in the pipeline? Auto manufacturers primarily use sub-assembly firms to manufacture the various pieces of the automobile; we are closing a sub-assembly deal this month and have deep experience in the space. However, it is the automaker, itself, that you must sell – and then they farm the actual work out to the sub-assembler. What discussions, if any, have you held with the automakers? As for retail distribution, to whom have you spoken and what has the result been?

3. Your capital raise, at $1.5mm, will not attract a credible Products VC. I suggest a raise of at least $3mm and possibly much more. The BizPlanBuilder software will help you to understand the thought processes that go into creating a Sources and Uses table. Simply put, imagine yourself with $10mm – how would you spend it to further the firm’s initiatives? Do the same exercise at $5mm and other amounts.

Our fees: We charge 6% of the deal amount for equity transactions and 4% of the deal amount if the deal is debt-based. This commission is, of course, payable at closing. Clients contribute $10,000 toward expenses, payable when our agreement is signed. We earn Warrants equal to 3% of the company’s issued shares, executable within 36 months of funding at a strike price equal to the valuation at closing.

VC funding is not quick. It takes a lot of hard work and a lot of research to acquire the correct capital partner. The fastest deal we’ve ever closed took 78 days; most take at least 6 months to a year.

VC funding is not quick. It takes a lot of hard work and a lot of research to acquire the correct capital partner. The fastest deal we’ve ever closed took 78 days; most take at least 6 months to a year.

I hope that the information, above, proves useful to you and I am open to speaking with you this week at your convenience.

Thanks very much.

– Chris

(Sadly, Chris Hintz has passed away.)

Got a success story of your own?

When you have a success to share, please click here and tell as much as possible about it. If you include a picture of yourself and/or your product or logo, we would love to post it here. Also, if you include your web address (URL) we can link to you and send others your way. Thank you very much!

Professional Business Planning Software Template

Whether you’re raising $5,000 – $50 million, or planning next year…

Whether you’re raising $5,000 – $50 million, or planning next year…

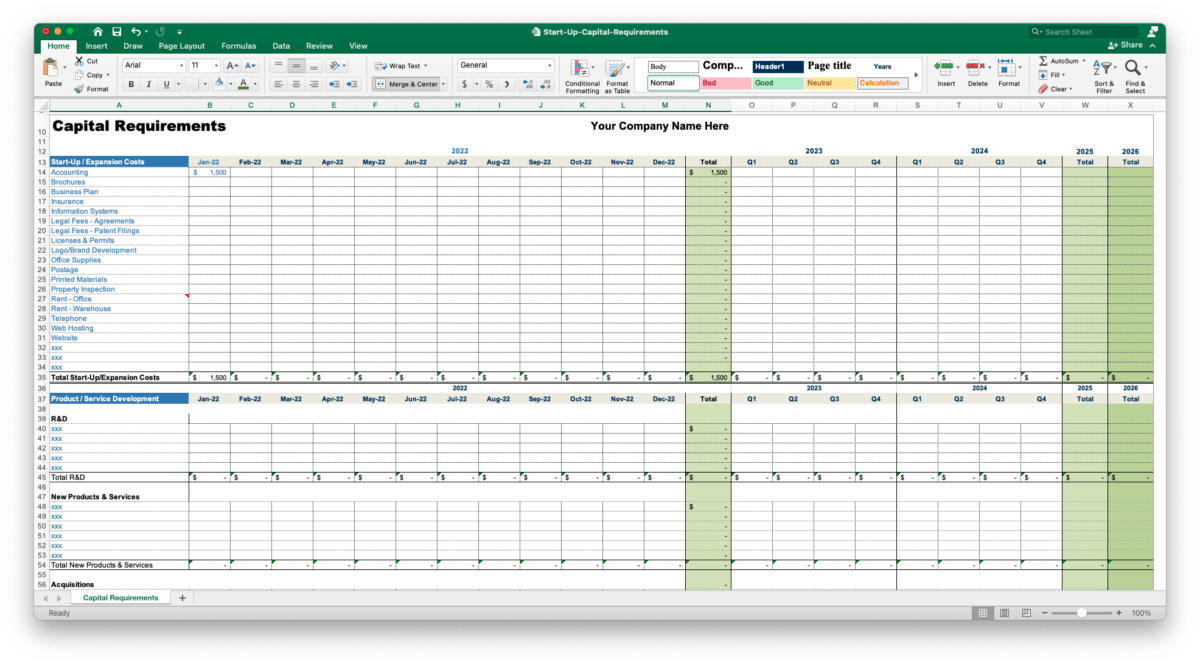

Write a winning business plan for your organization quickly and efficiently. BizPlanBuilder’s organized system of sample business plan templates are managed through a secure cloud-based dashboard, with a Word-like editor, flexible Excel-based financial models, PowerPoint presentation template and a variety of supporting docs all at your fingertips…

It’s the fastest and easiest way of turning your ideas into an investment-grade business plan and a successful business. BizPlanBuilder has been vetted with banks, SBA lenders, angel investors, and venture capitalists worldwide with more financing successes than any other app of its kind!

Click to learn more about BizPlanBuilder