Burke Franklin is an entrepreneur, author, and speaker who is best known for creating BizPlanBuilder business plan software and founding Business Power Tools, the company behind a massive collection of management tools for entrepreneurs, business owners and their advisors. He has over 40 years of experience in business and has helped thousands of entrepreneurs to start and grow their businesses.

Burke is also the author of several books, including "Business Black Belt" which provides practical advice for entrepreneurs and small business owners on how to build successful businesses. He is also a popular speaker and has given talks on entrepreneurship, business planning, and marketing at conferences and events around the world.

Burke Franklin is a strong advocate for entrepreneurship and believes that anyone can start and grow a successful business with the right tools and mindset. He is committed to helping entrepreneurs achieve their goals and has dedicated his career to providing the resources and support they need to succeed.

VIDEO – What investors and lenders look for in your business and in your plan — What to think about as you edit the “Government Requirements” section of your business plan and what investors and lenders (crowdfund, angel, venture capital, SBA) look for as they consider funding your start up or growing company.

Like this:

Like Loading...

VIDEO – What to think about as you edit the “Direct Competition” section of your business plan and what investors and lenders (crowdfunding, angels, venture capital, SBA) look for as they consider funding your start up or growing company.

Like this:

Like Loading...

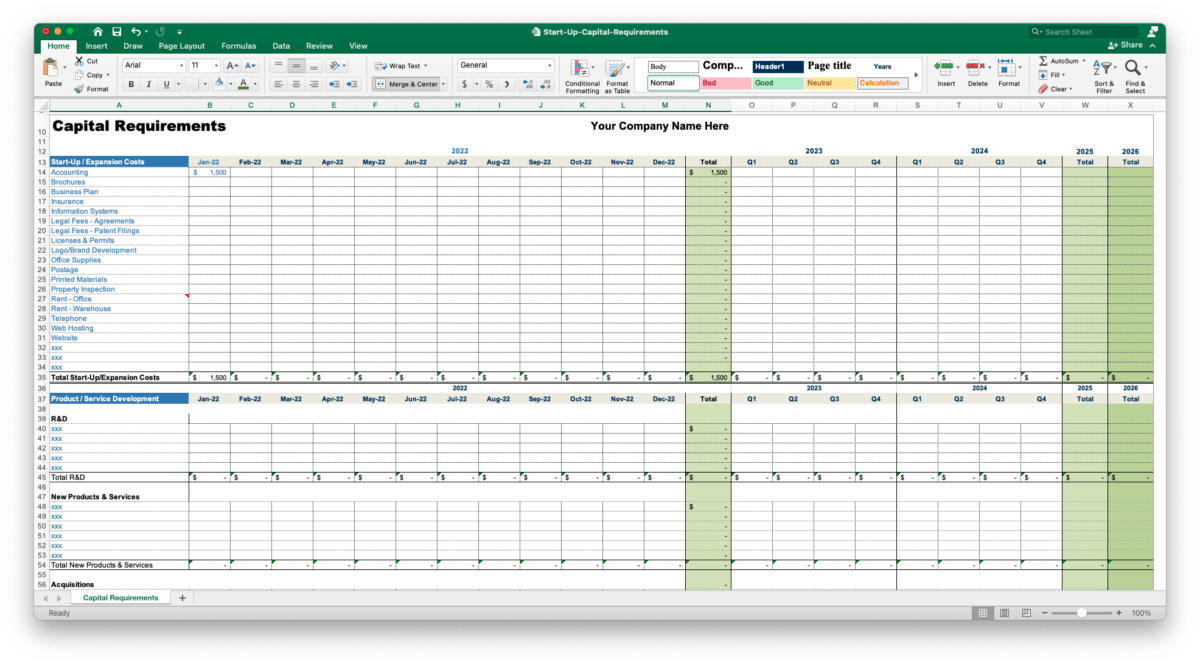

VIDEO – What to think about as you edit the “Use of Funds” section of your business plan and what investors and lenders (crowdfund, angel, venture capital, SBA) look for as they consider funding your start up or growing company. (How much money you need… For what? Here we summarize your capital requirements enabling investors to quickly see how to plan to apply their investment.)

Like this:

Like Loading...

VIDEO – What to think about as you edit the “Pricing Strategy” section of your business plan and what investors and lenders (crowdfunding, angels, venture capital, SBA) look for as they consider funding your start up or growing company.

Like this:

Like Loading...

VIDEO – What to think about as you edit the “Risk” section of your business plan and what investors and lenders (crowdfund, angel, venture capital, SBA) look for as they consider funding your start up or growing company.

Like this:

Like Loading...